Contents

Economics through its different theories and principles help to economic agents and participants in their decision-making processes and help them to get their objective fulfilled. For instance, a manager may have to think of what level of output he has to produce. Managers will produce the level of output that maximizes the form’s profit if he has set the objective of profit-maximizing. Likewise, he may have to go for selecting the least-cost mixture of factors to manufacture the best possible level of output. Thus, to produce a profit-maximizing level of output he will have to choose the combination of inputs that minimizes the cost of producing a given level of output. Here we will talk about basic mathematical concepts used in economics.

Optimality properties for an entire market system may be stated in mathematical terms, as in formulation of the two fundamental theorems of welfare economics and in the Arrow–Debreu model of general equilibrium . More concretely, many problems are amenable to analytical solution. Many others may be sufficiently complex to require numerical methods of solution, aided by software.

ClearTax can also help you in getting your business registered for Goods & Services Tax Law. Forecasting is a technique that uses historical data as inputs to make informed estimates that are predictive in determining the direction of future trends. Econometrics is particularly useful in solving optimization problems where a policymaker, for example, is looking for the best tweak out of a range of tweaks to affect a specific outcome.

Mathematical Economics: Definition, Uses, and Criticisms

While at the helm of The Economic Journal, he published several articles criticizing the mathematical rigor of rival researchers, including Edwin Robert Anderson Seligman, a noted skeptic of mathematical economics. The articles focused on a back and forth over tax incidence and responses by producers. Edgeworth noticed that a monopoly producing a good that had jointness of supply but not jointness of demand might actually lower the price seen by the consumer for one of the two commodities if a tax were applied. Common sense and more traditional, numerical analysis seemed to indicate that this was preposterous.

The IS/LM model is a Keynesian macroeconomic model designed to make predictions about the intersection of “real” economic activity (e.g. spending, income, savings rates) and decisions made in the financial markets . The model is no longer widely taught at the graduate level but is common in undergraduate macroeconomics courses. Only when all buyers are satisfied with the given market price would transactions occur. The market would “clear” at that price—no surplus or shortage would exist. The word tâtonnement is used to describe the directions the market takes in groping toward equilibrium, settling high or low prices on different goods until a price is agreed upon for all goods. While the process appears dynamic, Walras only presented a static model, as no transactions would occur until all markets were in equilibrium.

Cournot, a professor of mathematics, developed a mathematical treatment in 1838 for duopoly—a market condition defined by competition between two sellers. This treatment of competition, first published in Researches into the Mathematical Principles of Wealth, is referred to as Cournot duopoly. It is assumed that both sellers had equal access to the market and could produce their goods without cost. Each seller would vary her output based on the output of the other and the market price would be determined by the total quantity supplied. The profit for each firm would be determined by multiplying their output and the per unit Market price. Differentiating the profit function with respect to quantity supplied for each firm left a system of linear equations, the simultaneous solution of which gave the equilibrium quantity, price and profits.

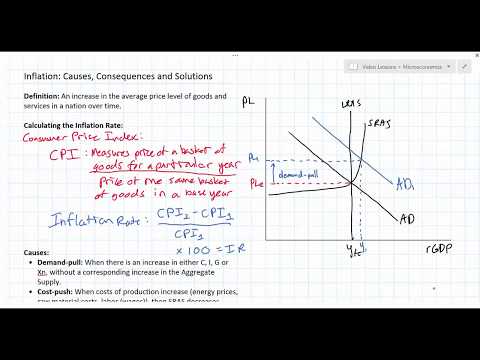

Mathematics helps economists to perform quantifiable experiments and create models for predicting future economic growth. From Main Street to Wall Street to Washington, decision-makers have become accustomed to hard, quantitative predictions about the economy due to the influence of mathematical economics. When setting monetary policy, for example, central bankers want to know the likely impact of changes in official interest rates on inflation and the growth rate of the economy.

Advantage and disadvantage of statistics

Moreover, controlled experiments in a laboratory are not possible in economics. So the majority of hypotheses remain untested and unverified in economics. The next step in deduction is merits and demerits of mathematical economics the framing of assumptions which are the basis of hypothesis. In any economic enquiry, more than one set of assumptions should be made in terms of which a hypothesis may be formulated.

Contemporary research on time series statistics consider additional formulations of stationary processes, such as autoregressive moving average models. More general models include autoregressive conditional heteroskedasticity models and generalized ARCH models. The method is said to benefit from continuing improvements in modeling techniques of computer science and increased computer capabilities. Issues include those common to experimental economics in general and by comparison and to development of a common framework for empirical validation and resolving open questions in agent-based modeling.

Tax Saving

Augustin Cournot and Léon Walras built the tools of the discipline axiomatically around utility, arguing that individuals sought to maximize their utility across choices in a way that could be described mathematically. At the time, it was thought that utility was quantifiable, in units known as utils. Cournot, Walras and Francis Ysidro Edgeworth are considered the precursors to modern mathematical economics. This inevitably leads to ambiguities of interpretation and the fudging of factors that can’t be readily fit into a mathematical or econometric model. Prior to the late 19th century, economics relied heavily on verbal, logical argument, situational explanations, and inference based on anecdotal evidence to attempt to make sense of economic phenomenon.

Friedrich Hayek contended that the use of formal techniques projects a scientific exactness that does not appropriately account for informational limitations faced by real economic agents. One example is qualitative scenario planning in which possible future events are played out. The surface of the Volatility smile is a 3-D surface whereby the current market implied volatility (Z-axis) for all options on the underlier is plotted against strike price and time to maturity (X & Y-axes). Linear programming was developed to aid the allocation of resources in firms and in industries during the 1930s in Russia and during the 1940s in the United States.

Even though the researcher’s bias heavily influences the discipline of economics, mathematics enables economists to describe an observable phenomenon and offers the backbone for theoretical interpretation. Although the discipline of economics is heavily influenced by the bias of the researcher, mathematics allows economists to precisely define and test economic theories against real world data. The most important advantage of mixed economy is that it provides encouragement to private sector and it gets proper opportunity to grow. A generalisation drawn under the inductive method is often histrico-relative in economics. Since it is drawn from a particular historical situation, it cannot be applied to all situations unless they are exactly similar.

Often, these applied methods are beyond simple geometry, and may include differential and integral calculus, difference and differential equations, matrix algebra, mathematical programming, or other computational methods. Proponents of this approach claim that it allows the formulation of theoretical relationships with rigor, generality, and simplicity. Proponents of mathematical economics claim that the primary advantage of this particular approach is that it permits the formation of theoretical economic relationships through generalizations with simplicity. Mind you, the “simplicity” of this approach to the study of economics is certainly subjective. An understanding of mathematical economics is particularly important for students considering the pursuit of a graduate degree in economics as advanced economics studies make great use of formal mathematical reasoning and models.

- In fact, many are often utilized in the studies of other sciences as well.

- Gottfried Achenwall lectured in this fashion, coining the term statistics.

- It has also given rise to the subject of mechanism design , which has private and public-policy applications as to ways of improving economic efficiency through incentives for information sharing.

- The solution of the resulting system of equations (both linear and non-linear) is the general equilibrium.

Under this system, both private and public sectors work for the efficient use of resources. Public sector works for social benefit while private sector makes the optimum use of these resources for maximisation of profit. In a mixed economy, there is both economic and occupational freedom https://1investing.in/ as found in capitalist system. Every individual has a liberty to choose any occupation of his choice. Similarly, every producer can take decisions regarding production and consumption. Besides the statistical method, the other method used in induction is of controlled experimentation.

Econometrics

Later work extended their results to computational methods of modeling. There are chances of errors becomes easy when the statistical methods are not done by the experts. We can get the changed values of Y for taking diverse values of the independent variable X. The given specific demand function tells that a unit drop in the price of the product, there will increase in the demand quantity by 0.5 units. If the price is zero, then the term (0.5P) in the demand function will also account zero and the quantity demanded is equal to 7.

Again the use of statistics in induction cannot prove a hypothesis. It can only show that the hypothesis is not inconsistent with the known facts. In reality, collection of data is not illuminating unless it is related to a hypothesis. Definitions, sources and methods used in statistical analysis differ from investigator to investigator even for the same problem, as for instance in the case of national income accounts. However, the inductive method is not without its weaknesses which are discussed below. This method of analysis is based on the assumption that economic conditions remain constant.

Look up mathematical economics in Wiktionary, the free dictionary. In Russia, the mathematician Leonid Kantorovich developed economic models in partially ordered vector spaces, that emphasized the duality between quantities and prices. Kantorovich renamed prices as “objectively determined valuations” which were abbreviated in Russian as “o. o. o.”, alluding to the difficulty of discussing prices in the Soviet Union.

In this, changing economic phenomena can be analysed on the basis of experiences, conclusions can be drawn, and appropriate remedial measures can be taken. Thus, induction suggests new problems to pure theory for their solution from time to time. The inductive method was employed in economics by the German Historical School which sought to develop economics wholly from historical research. The historical or inductive method expects the economist to be primarily an economic historian who should first collect material, draw gereralisations, and verify the conclusions by applying them to subsequent events. The Engel’s Law of Family Expenditure and the Malthusian Theory of Population have been derived from inductive reasoning.