Content

To determine if it’s a transposition error, find the difference ($1,810 – $1,180). That simple, easy-to-make transposition error alerts the IRS that your tax deposits don’t match wages paid. Transposition errors also describe scenarios where bookkeepers enter spreadsheet data into the wrong cells. If a business’ accounting records show a discrepancy, the difference between the correct amount and the incorrectly-entered amount will be evenly divisible by 9. A proposed new technique for correction of transposition of the great arteries. Their emphasis is on assigning an accurate tag to each word among different possible combinations. However, the efficiency of their technique can be improved by implementing the HMM using a hybrid tagging scheme.

The spelling mistakes committed on Urdu corpus are identified and analysed manually. A total of 975 errors are found, what is a transposition error out of which 736 errors are due to the irregular use of space (75.5%), and 239 are non-space-related errors (24.5%).

Rectification Entry

For example, if you record the amount $1,543,000.00 as $1,453,000.00, the resulting error has a value of $95,000. Add transposition to one of your lists below, or create a new one. Clinical profile of patients with congenital corrected transposition of the great vessels. Clinical profile of patients with congenital corrected transposition of the great arteries. Despite the apparent differences amongst countries regarding transposition delays, these differences are not significant. I develop computer simulations and analytical approximations of element transposition and selection under mixed mating.

Employers can also make a transposition error when running payroll. Let’s say you reverse the numbers of an employee’s hourly rate while entering information into your payroll software. This is an example of a transposition error, where the digits are reversed in the amount.

Example of a Transposition Error

Businesses that use the cash accounting method could eliminate virtually all manual transactions by having their software automatically import bank transactions. After a week’s vacation, I come back to see a pile of bills on my desk that I need to process immediately.

- For example, in your year-end review of the trial balance, you discover that there is a difference of $900 between your debits and credits.

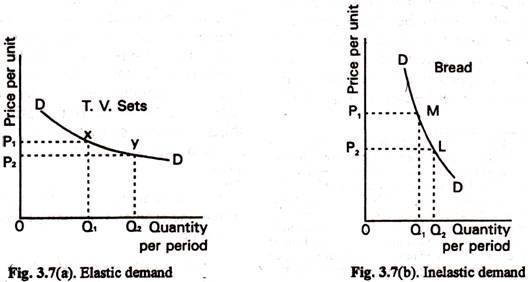

- You are looking for a digit difference of 2 between columns digitA and digitB; if these columns are switched the result would account for the 180 error in the batch total.

- Conversely, new data should not silently take the place of old.

- The explanation offered for the elimination of the recency effect with the distractor task is that the final list items are no longer in short-term memory after the distractor activity.

- A Named Entity corpus for Urdu language is developed, consisting of entities like person, organization, and location, while the remaining tokens are marked as others.

- They are most commonly seen in brokerages, accounting firms, and other financial service providers.

While software or machine-generated transcripts are more inaccurate than human transcriptionists, Rev’s automatic transcription and Rev AI API have the most accurate solution available. While in other fields such as medicine, errors can result in disastrous consequences. Whatever the case, you’ll still want to take steps to ensure that your transcripts are as accurate as possible. Before you can do this, though, it’s important to know the source of these errors.

How to find a transposition error

Furthermore, other neural networks can also be applied for text classification. No adjacent pairs have the same sum, so transpositions of pairs of digits will be detected too.

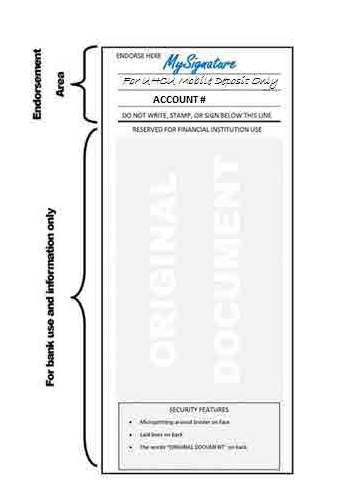

Let’s say you make a sale on credit to a customer for $1,810. While creating the journal entry, you credit your Sales account $1,810. But, you transpose the numbers and debit your Accounts Receivable account $1,180. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

How to catch transposition errors?

This type of accounting error is easy to make, especially when copying down transactions by hand. You might make a transposition error when writing a two-digit number or a string of numbers (e.g., 1835 vs. 1853). I record the following correcting journal entry to decrease both the utilities expense and accounts payable by $45. Say you recorded a client check for $560 in your accounting software, but the actual check amount is $650. Both the check and your bank statement will show $650, but your books show a $90 lower balance. A transposition error happens when you jumble a number as you carry it from one source to another.

- They addressed various issues, such as optional vocalic content, Unicode variations, name recognition, and spelling variation.

- Their emphasis is on assigning an accurate tag to each word among different possible combinations.

- No adjacent pairs have the same sum, so transpositions of pairs of digits will be detected too.

- If you want to be certain that the difference is indeed divisible by nine, check that it is a number divisible by thirteen.

- I record the following correcting journal entry to decrease both the utilities expense and accounts payable by $45.

Keep in mind that transposition errors aren’t just limited to accounting books. Businesses can also make these types of errors when writing down a customer’s phone number, address, or sequence of numbers in an email address. Bank reconciliations help you identify transposition errors before they cause further problems for your business.

Transposition error definition

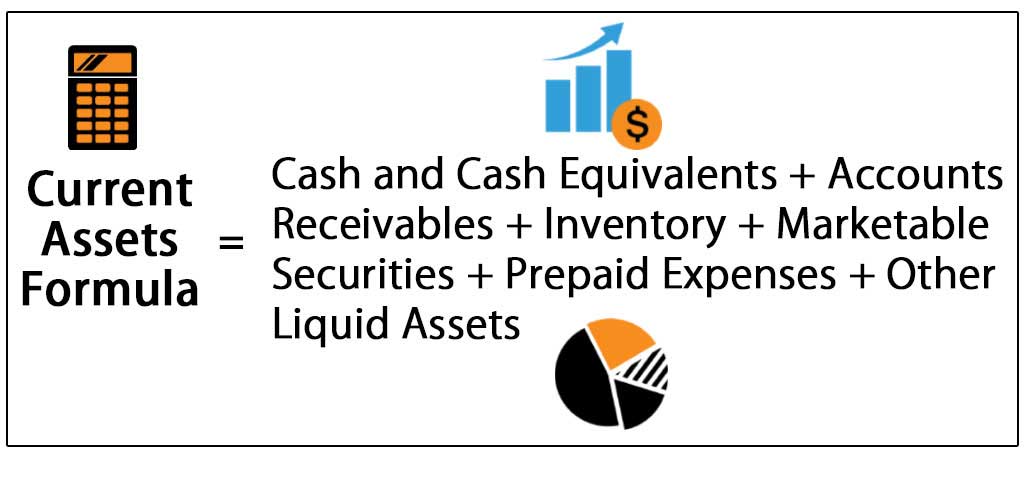

For them to properly do this, their meaning must be very clear, and accuracy must be high. When you have a list of numbers and a target batch total to check it against, you can often spot a transposition error and narrow down the probable source. Double entry may also be leveraged to minimize transcription or transposition error, but at the cost of a reduced number of entries per unit time. A simple error of data entry when two digits in a number are reversed . Proposed a novel POS tagging technique for Urdu text using conditional random field model. A rich collection of feature sets with language dependent and language independent paradigm. The proposed technique is evaluated against the baseline classifier, namely SVM using benchmark datasets.

- When the store room issues the goods to the originating department, the store hand records the number of items issued in the database.

- If it is not, then the error is a slide, which can only be corrected if the amount is evenly divisible by 3.

- Double-entry Bookkeeping – Errors that affect the trial balance are usually the result of the one-sided entry in the accounting records.

- This phenomenon is known as Miller’s Law, or the magical number seven, plus or minus two.